cash advance loans how do they work

If you’re unable to meet it needs, you ought to safe an investment property financing

Having developing a manager-occupied business, you are required to explore 51 per cent of the property. Investment property loans be a little more suitable for entrepreneurs who need to order assets and you can lease all of them for extra winnings. It’s also possible to make use of this to help you flip and sell old home.

Conduit otherwise CMBS Fund

An excellent conduit financing, referred to as a professional home loan supported security (CMBS) financing, is a kind of industrial home loan backed by an effective first-updates mortgage. Conduit funds try pooled plus a varied band of most other mortgage loans. Upcoming, he or she is set in a real Home Home loan Capital Conduit (REMIC) believe and you will ended up selling so you can buyers. For each and every ended up selling financing deal a threat comparable to their rate of get back. Such financing is also used for functions such as for example shopping buildings, department stores, warehouses, offices, and lodging.

Conduit finance provide exchangeability to help you real estate traders and you may commercial loan providers. They are package from the conduit lenders, industrial banking institutions, and financing finance companies. This type of loans constantly have a fixed rate of interest and you may a great balloon payment by the end of one’s title. Some lenders together with allow attract-merely repayments. Conduit fund was amortized having 5, eight, and ten-year words, plus twenty-five and 29-12 months terminology.

SBA Fund

The small Providers Management (SBA) now offers protected industrial loans to help you licensed candidates. Brand new SBA was a federal institution dedicated to help businesses into the protecting loans. It help to lower default exposure for loan providers best personal loans in Memphis and come up with it easy for advertisers to get into resource. The newest SBA will not lend to borrowers, however, provide financial support as a consequence of spouse lenders, micro-financing associations, and you will society advancement teams.

SBA 7(a) Funds

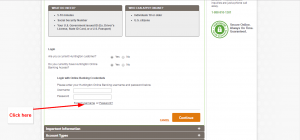

SBA eight(a) financing is employed to have development manager-filled business assets. If you’re looking to create a new industrial facilities or upgrade a classic office, this will meet your needs. Likewise, a corporate is approved to possess an SBA 7(a) mortgage when they entertain more fifty percent of the house. An SBA seven(a) financing ount in the event your home loan try $150,000. If you like a top amount borrowed, brand new SBA can be verify around 75 %.

Which mortgage is drawn because repaired-rates financial, an adjustable-price mortgage, or since the a variety of the newest tow. SBA 7(a) finance totally amortize and you will usually paid-up so you can twenty five years. Furthermore, the maximum rates for this particular financial support will be based upon the modern finest price.

Accredited borrowers can also be safe around $5 million out-of an SBA-supported bank. SBA 7(a) finance appear in fully amortized financing as high as 20 or twenty five years.

- Grow a corporate

- Expose or to get a corporate

- Financing list

- To order equipment and you will gadgets

- Remodel otherwise create houses

- Re-finance existing company personal debt not related toward property

SBA 504 Fund

A different sort of popular SBA industrial mortgage ‘s the SBA 504 loan. Its geared toward consumers exactly who utilize more 50 % of the current commercial possessions. These mortgage is prepared that have dos funds: One to area of the mortgage need to be financed that have an authorized Invention Organization (CDC) and therefore is the reason 40 % of your loan amount. One other area should be financed by the a lender which can bring fifty percent of the amount borrowed.

With a keen SBA 504 mortgage, you can see as much as f $5.5 mil from your CDC financial. In addition, you might safer up to $5 billion about financial bank. You can use such loan so you’re able to safer big financial support compared to an SBA eight(a) program. SBA 504 fund feature a totally amortized commission design which have a phrase as much as 2 decades.